Rants, Raves and Revelations – February

By Harry {doc} Babad

Some Sound Advice About Credit Card Protection

I received some of this material, second or perhaps third hand, purportedly from retired lawyer who usually sends out just jokes to a select electronic (email) mailing list.

But this is serious business, personal information containing many of my records was stolen from a federal contractor who’s fiduciary duty it was to protect it.

[So far mo ill results, but I’ve done many all of the things that are recommended below; and in real time – when I received the notification letter tell me of the information theft. I’ve now supplemented my preventive measures with things I learn for the attorney email.]

You might want to consider doing some or all of these things if you're not doing them already. Oh, and you don’t need books, you don’t need unusual software based protective programs and you most certainly don’t need to buy protection service… Just take mostly common sense prevention measures.

Two caveats and a Tidbit:

1. I have checked the email posted suggestions against advice from Consumer Reports [http://www.consumer.gov/idtheft/], the AARP site [http://www.aarp.org/], and to some degree the credit reporting agencies and found the recommendations both valid and consistent.

2. I have not been able to find the original post or source on the Internet, but not for want of trying.

3. I’ve added a reading list to the end of this article for those who want to dig deeper. The list is neither comprehensive nor complete, if you want more Google it!

In accordance with what I’ve read, I recommend that you to consider doing some or all of these things. I’ve added a few other items to the original’s content [my additions are in italics]. These are actions that I’ve discovered as part my ongoing reading and want to share with you … it’s all good!

…doc

§ § § § § § § § § § § § § § § § § §

A corporate attorney sent the following out to the employees in his company…

CHECKS & CREDIT CARDS

CHECKS & CREDIT CARDS

- The next time you order checks have only your initials (instead of first name) and last name put on them. If someone takes your checkbook, they will not know if you sign your checks with just your initials or your first name, but your bank will know how you sign your checks.

- Do not sign the back of your credit cards. Instead, put "PHOTO ID REQUIRED."

- When you are writing checks to

pay on your credit card accounts, DO NOT put the complete account number

on the "For" line. Instead, just put the last four numbers.

[Actually, I write CC payment, they’ve got the top part of my statement with my check.] The credit card company knows the rest of the number, and anyone who might be handling your check as it passes through all the check processing channels won't have access to it.

- Mail outgoing items in an official protected mailbox thereby eliminating personal information from easy theft. [It’s easier to steal your outgoing mail than your wallet.]

- Put your work phone # on your checks instead of your home phone. If you have a P.O. Box, use that instead of your home address. If you do not have a P.O. Box, use your work address. Never have your SS# printed on your checks. (DUH!) You can add it if it is necessary. But if you have it printed, anyone can get it.

- Take delivery of new checks at your bank if possible, eliminating them from the mailbox in front of your home.

YOUR WALLET & MINE

YOUR WALLET & MINE

- Keeping Track — Place the contents of your wallet on a photocopy machine or scanner. Xerox or scan both sides of each license, credit card, each medical card, you social security card, etc. You will know what you had in your wallet and all of the account numbers and phone numbers to call and cancel. Keep the photocopy in a safe place.

I no longer carry my Social Security Card in my wallet. I’ve also removed the SSN number from my Medicare card and a few other cards that use it as an ID; if someone needs it they’ll ask. I’ve also written companies requesting an ID number that is NOT my Social Security number. One complied.

- Make sure that you SS number is not on your drivers license. Most states will re-issue a new drivers license w/o the SSN. With a little bit of luck you’ll get a better looking picture too.

- The originator of the advice in this article also now carries a photocopy of his passport when traveling either in the US or abroad. [I don’t get this one, unless its extra emergency ID, but posted it anyway.]

The Attorney Author’s Experience – The tale unfolds

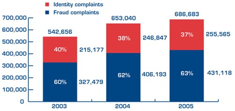

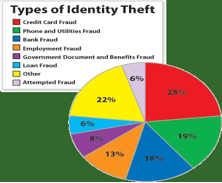

We've all heard horror stories about fraud that's committed on us in stealing a name, address, Social Security number, and credit cards.

Unfortunately I, an attorney, have firsthand knowledge

because my wallet was stolen last month. Within a week, the thieve(s) ordered

an expensive monthly cell phone package, applied for a VISA credit card, had a

credit line approved to buy a Gateway computer, received a PIN number from the

Department of Motor Vehicles

to change my driving record information online, and more. But here's some

critical information to limit the damage in case this happens to you or

someone you know:

An Instant Action List

We have been told we

should cancel our credit cards immediately. But the key is having the toll

free numbers and your card numbers handy so you know whom to call. Keep

those where you can find them. [I keep them in a database, encrypted of

course, on my computer – it’s NOT a portable.]

We have been told we

should cancel our credit cards immediately. But the key is having the toll

free numbers and your card numbers handy so you know whom to call. Keep

those where you can find them. [I keep them in a database, encrypted of

course, on my computer – it’s NOT a portable.]

- File a police report immediately in the jurisdiction where your credit cards, etc., were stolen. This proves to credit providers you were diligent, and this is a first step toward an investigation (if there ever is one.) But here's what is perhaps most important of all: (I never even thought to do this.)

- Call the three national credit-reporting organizations immediately to place a fraud alert on your name and Social Security number.

- Notify banks, creditors, and utilities. Close accounts that have been used by thieves. Choose new passwords and PINs for all your accounts and don't use your mother's maiden name as a password. Notify merchants that issued credit or accepted bad checks in your name; use your police report or FTC affidavit as backup.

- Order your credit report each year. Get credit reports from all three credit bureaus, and study them closely. [http://www.annualcreditreport.com/ 887-322-8228] Some victims say that it took years to clear their credit files and that new credit was sometimes granted in their names without their permission even after fraud alerts were placed on their accounts. [One report a year from each credit agency is now by federal law yours for free; stagger them across the year. Previously you had to claim a loss of identifying material such as a credit card.]

I had never heard of needing to file a credit agency report that until advised to do so by a bank that called to tell me an application for credit was made over the Internet in my name. The alert means any company that checks your credit knows your information was stolen, and they have to contact you by phone to authorize new credit.

By the time I was advised to do this, almost two weeks after

the theft, all the damage had been done. There are records of all the credit

checks initiated by the thieves' purchases, none of which I knew about before

placing the alert. Since then, no additional damage has been done, and the

thieves threw my wallet away. This weekend (someone turned it in). It seems to

have stopped them, the thieves, dead in their tracks.

Now, here are the numbers you always need to contact about your wallet, etc., has been stolen |

1) Equifax: 1-800-525-6285 2) Experian (formerly TRW): 1-888-397-3742 3) Trans Union: 1-800-680-7289; and 4) Social Security Administration (fraud line): 1-800-269-0271 5) Fill out the Federal Trade Commission’s universal fraud affidavit. Tell the credit agencies that you want to flag your file with a fraud alert. Put a security freeze on your credit report so no one can access it without notifying you first - tedious, awkward but protective – or are you In the business of giving you money away no questions asked. |

Information

About You and Me is Out There for the Taking:

Information

About You and Me is Out There for the Taking:

Getting information about us now relatively easy and the absence of Federal action continues to make all of use more vulnerable to Identity theft even when out wallets aren’t lost or stolen. A brief Internet search turned of these information sources. All available on the cheep. Data aggregators get wealthy by selling information about you and me with few protections and less corporate liability for things gone wrong than you face if you have a car accident. As we’ve noted in macCompanion, many of these sites have porous data security as evinced by the number of times thousands of records have been stolen from them.

Find Publicly Available Personal Information – A small sampling of resources |

Search Systems — http://www.searchsystems.net/ Public Record Finder Plus — http://www.usa-people-search.com/?from=2378746&aegis_tid=37144917&aegis_cid=397408441 http://find.intelius.com/search-name.php?ReportType=1&&PHPSESSID=77039a867d9b934040dafb7ac4f41694 |

A

Short List of Further Reading

A

Short List of Further Reading

This is neither comprehensive nor complete — is just articles I’ve found personally useful. These articles cover a wide range of protective advice; probably the most unnerving is the article on theft of Medical records. Why… Medical identity theft—in which fraudsters impersonate unsuspecting individuals to get costly care they couldn't otherwise afford—is growing. There’s little or no protection or required recourse, unlike protection against the more usual types of credit related identity thefts, the consumer protection laws are lacking.

Protect your privacy [Working Mac] By Daniel Tynan. http://www.macworld.com/2006/04/secrets/mayworkingmac/index.php?pf=1

Secrets of the digital detectives, Sep 21st 2006, From The Economist print edition. http://www.economist.com/PrinterFriendly.cfm?story_id=7904281

Top Ten Signs You're about to get ripped off by Fred Showker; http://www1.iwvisp.com/croton/Top%20Ten%20Signs.htm

Stop ID Theft by Simpson Garfinkel, Technology Review; http://www.technologyreview.com/Biztech/13390/

Identity theft: What you can do, Consumer Reports, June 2006.

Preventing Identity Theft — An AARP Seminar http://www.aarp.org/learntech/personal_finance/identity_theft_intro.html

Diagnosis: {Medical} Identity Theft, Business Week Online, January 8, 2007

http://www.businessweek.com/print/magazine/content/07_02/b4016041.htm?chan=gl

Consumer Report Fact Sheet – How To Prevent Identity Theft, Consumer Reports, August 2005, http://www.consumerreports.org/cro/cu-press-room/pressroom/eng0509pit.htm

For other information, check out the nonprofit Identity Theft Resource Center at www.idtheftcenter.org and the Privacy Rights Clearinghouse at www.privacyrights.org.